- Enroll Now - Medicare Advantage by Doc and Zip

- Health Exam Guide

- AHIP

- AHIP EXAM 50 FLASHCARDS

- 2024 - Medicare Fraud, Waste, & Abuse

- 2024 - Nondiscrimination

- 2024 - General Compliance

- Medicare Enrollment Periods

- Request a Call Back from Rachael

- Hi! I'm Rachael Kathleen Rawlins, your Insurance Agent and Retirement Planner.

- Enroll in a Medicare Plan

- Rachael's Dashboard

- I'm your MO & AR Medicare Insurance Agent. Question? Ask me.

- Book an Appointment

- Forex Trading

- AHIP 2025

- Nondescrimination

- General Compliance Training

- Medicare Cheat Sheet

- I am licensed in AR, MO, NY, OH, WV, VA, FL, TX, SC

- Health Exam Guide

- Enroll Now - Medicare Advantage by Doc and Zip

- Health Exam Guide

- AHIP

- AHIP EXAM 50 FLASHCARDS

- 2024 - Medicare Fraud, Waste, & Abuse

- 2024 - Nondiscrimination

- 2024 - General Compliance

- Medicare Enrollment Periods

- Request a Call Back from Rachael

- Hi! I'm Rachael Kathleen Rawlins, your Insurance Agent and Retirement Planner.

- Enroll in a Medicare Plan

- Rachael's Dashboard

- I'm your MO & AR Medicare Insurance Agent. Question? Ask me.

- Book an Appointment

- Forex Trading

- AHIP 2025

- Nondescrimination

- General Compliance Training

- Medicare Cheat Sheet

Rachael Rawlins

- Key Facts

- Glossary

- General Insurance

- Accident & Health Insurance Basics

- Individual Accident & Health Insurance Policy Provisions

- Disability Income and Related Insurance

- Medical Plans

- Group Health Insurance

- Specialized Health Insurance for Qualified Individuals

- Federal Tax Considerations for Accident and Health Insurance

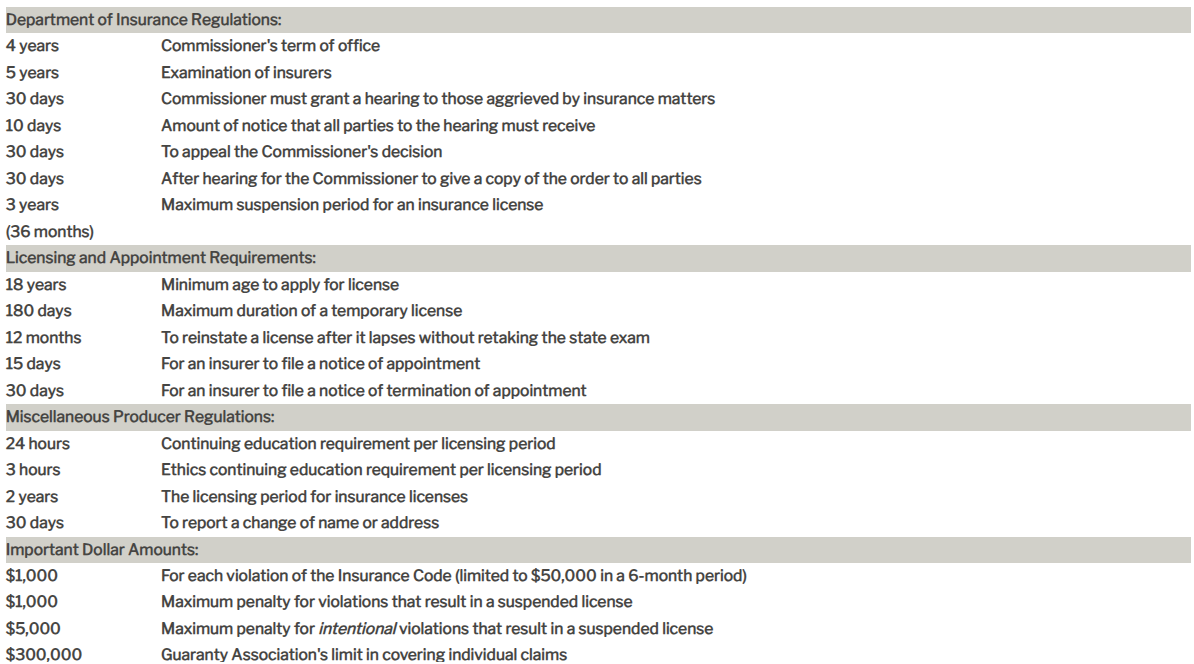

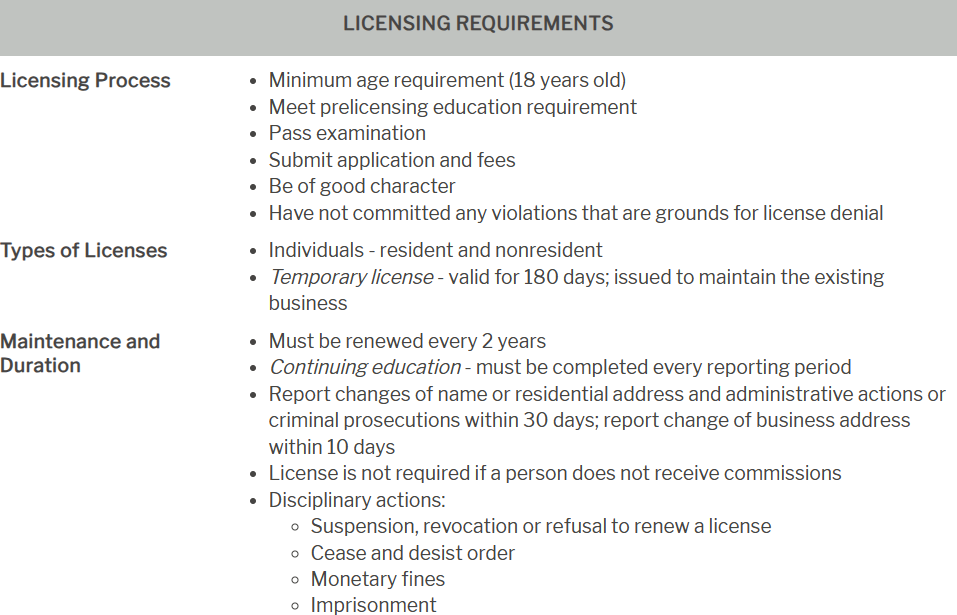

- Arkansas Statutes, Rules & Regulations for Life & Health

- Arkansas Statutes, Rules & Regulations pertinent to Health Only

-

Key Facts

Key Facts for Arkansas Health Insurance2-50 Employees- Small Employer

2 Types of Plans - Small Employer

30+ Hours Full Time Employee

- Maternity benefits:

- 48 hours for vaginal delivery; 96 hours for cesarean section

48 Hours vaginal delivery notification

96 Hours Cesarean delivery notification

Health care insurers may not restrict a hospital stay for the mother and a newborn child to less than 48 hours for a vaginal delivery and 96 hours for a cesarean section.

1-45 Days reinstated when the company says or after 45 days, whichever comes first.

5 Days coverage for newborn infants must include routing nursery care and pediatric costs for a well newborn child for up to 5 full days in a hospital nursery or until the mother is discharged from the hospital, whichever is the shorter period.

10 Days Reinstatement probationary period starts for sickness only

14 Days Policies providing convalescent or extended care benefits following hospitalization cannot condition those benefits upon being admitted to the convalescent facility within 14 days of being discharged from the hospital.

Health Grace Period for payments - (7 days for weekly premium policies, 10 days for monthly premium policies and 31 days for all other policies)

30 Days to give back and be refunded for a medicare supplement policy.

60 Days legal actions provision before a client can sue

60 Days time payment of claims provision (so they can investigate the claim)

*** conflicting

Benefits must be payable immediately upon receipt of proof of loss and benefits for loss of time must be payable within 30 days of the period for which the insurer is liable

60 Days If the Commissioner does not disapprove the HMO's actions within 60 days of filing, the exercise of power is approved.

60 Days The Commissioner must approve or deny an application for underwriting restrictions within 60 days.

3 Months COBRA - Continuation of coverage is available only to individuals who have been insured continuously under the group policy in the 3 months before the event that terminated coverage.

Individuals must request continuation of coverage in writing no later than 10 days

90 Days Notification of the birth of the newborn child and payment of the required premium must be furnished to the insurance company within 90 days after the date of birth.

90 Days If an insurer elects to discontinue offering a particular health benefit plan, it must provide notice of discontinuation to all affected insureds at least 90 calendar days prior to the date the health benefit plan will be discontinued by the carrier.

90 Days Provide proof of loss

20 Days Provide notice of loss

90 days probationary period for health insurance coverage

180 Days If an insurer elects to nonrenew all of its health benefit plans, the insurer is required to provide advance notice of its decision to the Commissioner and all affected insureds at least 180 calendar days prior to nonrenewal

6 Months

- Pre-existing condition exclusion: no longer than 6 months

6 Months Medicare supplement policy or certificate may not exclude or limit benefits for losses incurred more than 6 months from the effective date of coverage because it involved a pre-existing condition. The policy cannot define a pre-existing condition more restrictively than a condition for which medical advice was given or treatment was recommended by or received from a physician within 6 months before the effective date of coverage.

12 months Probationary Period Max

2 Years HMOs that have been in operation for at least 2 years may offer an annual open enrollment period of at least 1 month.

24 Months Each policy must provide a minimum benefit of $6,000 for each 24-month period, no more than half of which can be spent during any period of 30 consecutive days. Each recipient of these benefits is limited to a minimum lifetime amount of $12,000.

2 Years Incontestibility Provision / time limit on certain defenses clause

5 Years If an insurer elects to nonrenew all of its health benefit plans, the insurer is required to provide advance notice of its decision to the Commissioner and all affected insureds at least 180 calendar days prior to nonrenewal

- Time limit on certain defenses — After a policy has been in force for 3 years, no misstatements, except fraudulent misstatements, made by the applicant, can be used to void the policy or to deny a claim.

3 Years To file loss and make a claim (maximum)

100 min members in operation for min 2 years for blanket coverage

(7 days for weekly premium policies, 10 days for monthly premium policies and 31 days for all other policies)

Short-Term Disability Insurance – A group or individual policy that covers disabilities of 13 to 26 weeks, and in some cases for a period of up to two years.

Group - Continuation of coverage may only be made available to individuals who have been continuously insured for 3 months prior to termination or change in marital status. An individual who wishes to continue coverage must request continuation in writing no later than 10 days after the terminating event and pay the required premium on a monthly basis and in advance.

An individual must apply for conversion no later than 30 days after termination of group coverage.

Coverage must end at the earliest of

- 120 days after continuation of coverage began

Terminally Ill – In most states, this is defined as a patient who is expected to die within 6 months of a specific illness or sickness.

- Substance abuse:

- $6,000 for each 24-month period; $12,000 lifetime minimum

- Time limit on certain defenses: 3 years

- Grace period:

- 7 days for weekly premiums

- 10 days for monthly premiums

- 31 days for any other premium mode

- Reinstatement: immediate coverage for accidents; 10-day waiting period for sickness

- Notice of claim: 20 days

- Claim forms: insurer furnishes within 15 days of notice of claim

- Proof of loss: written proof within 90 days after the end of the period for which the insurer is liable

- Payment of claims: immediately upon receipt of written proof of death

- Legal action: after 60 days but not later than 3 years after proof of loss

Key Facts A. General Insurance Key Concepts:

- Insurance is defined as the transfer of PURE risk to the insurance company in consideration for a premium.

- The chance of loss without any chance of gain is called pure risk.

- Speculative risk has the possibility for gain or loss and is not insurable.

- Risk is defined as the chance of loss.

- A condition that could result in a loss is known as an exposure.

- A hazard is something that increases the chance of loss.

- The presence of a physical hazard increases the chance of a loss occurring.

- A peril is defined as a cause of loss, such as fire.

- To be insurable, losses must be calculable.

- The law of large numbers allows insurers to predict claims more accurately.

- The law of large numbers applies to groups of people, not to individuals. The more people in the group, the more accurate the predictions are.

- Most insurers buy reinsurance to protect themselves in the event of a catastrophic loss.

- Insurance laws are not required to be uniform from one state to another.

Insurers:

- A stock insurer may pay dividends to its shareholders (stockholders), but they may not be guaranteed.

- A reciprocal insurance company is managed by an attorney-in-fact.

- An unincorporated association of individuals who insure each other is known as a reciprocal insurer.

- The government offers insurance primarily based upon social needs, such as flood insurance and workers compensation, but does not offer insurance for the purpose of preventing fraud.

- A foreign company has their home office in another state.

- An insurer incorporated outside of the U.S. who sells in the U.S. is an alien company.

Producers and General Rules of Agency:

- A producer may be personally liable when violating the producer's contract.

- Producers represent the insurance company, not the insured.

- Independent producers own their own accounts and are not insurance company employees.

- Producers have express, implied and apparent authority.

- The authority a producer has that is written in his or her contract is known as express authority.

- A producer's binding authority (if any) is expressed (written down) in the producer's contract with the insurer the producer represents.

- The authority not expressly (written) granted, but is actual authority the producer has to transact normal business activities, is known as implied authority.

Contracts:

- The elements of a legal contract may be remembered by the acronym C-O-A-L (consideration, offer, acceptance, legal purpose, and legal capacity).

- A requirement for a valid contract is offer and acceptance, or mutual agreement.

- Advertising the availability of insurance is not considered to be an offer.

- A specific and definite proposal to enter into a contract is known as an offer.

- The consideration on a policy need not be equal.

- A policy may not be voided due to unequal consideration.

- Under the consideration clause, something of value must be exchanged.

- Because insurance contracts are contracts of adhesion, policy ambiguities always favor the insured.

- Insurance policies are unilateral contracts because only one party makes an enforceable promise.

- The principle of indemnity states the purpose of insurance is to restore the insured to the same position as before the loss occurred.

- The principle of utmost good faith states that all parties to an insurance transaction are honest.

- A representation is defined as the truth to the best of one's knowledge.

- A warranty is defined as a sworn statement of truth, guaranteed to be true.

- A breach of warranty may void a contract.

- Concealment is defined as the failure to disclose a material fact. When an insurer voluntarily gives up the right to obtain information that they are entitled to, they have made a waiver.

B. Accident And Health Insurance Basics A peril is a cause of loss. Health insurance covers two perils: accident and sickness.

- Occupational coverage covers both on-and off-the-job injuries (for those not covered by workers compensation). Nonoccupational coverage covers off-the-job injuries only (for those covered by workers compensation).

- An AD&D policy will pay the capital sum for loss of a limb, in addition to any medical expense insurance coverage that may apply.

- Limited health insurance policies (like AD&D) only cover limited perils and amounts.

- A hospital indemnity policy would pay a stated amount (in addition to any other insurance the insured may have) when the insured is confined in the hospital.

- AD&D and hospital indemnity policies do not follow the principle of indemnity. They pay in addition to other policies the insured may have.

- Credit disability insurance will pay an insured's car payments if the insured is sick or injured and cannot work.

- A blanket disability policy may be written to cover passengers on a common carrier, an employee group, a student group, a debtor group, or a sports team.

- Blanket policies do not require individual applications, nor are certificates of insurance issued to those covered.

Underwriting:

- An application must be in writing and will become part of the policy when issued.

- If an application is approved and a policy is issued, the producer must collect the premium along with a statement of continued good health.

- Health insurance underwriters often order an attending physician's report in order to determine an applicant's current medical condition.

- Issuing a conditional receipt starts coverage right away if all conditions have been satisfied.

C. Individual Accident And Health Insurance Policy Provisions Uniform Required Provisions:

- Mandatory provisions, such as the grace period, protect the insured. Optional provisions, such as probationary periods, protect the insurance company.

- Except for fraud, health insurance policies are incontestable after they have been in force for 2 years.

- The probationary period is different from the time limit on certain defenses provision (incontestability); the maximum probationary period is usually 12 months and the incontestability provision is usually 2 years.

-

The maximum health insurance probationary period in Arkansas is typically 90 days, according to standard practices. Health insurance probationary periods are the waiting periods that employees must endure before their health insurance benefits become effective.

Arkansas adheres to the common practice of a 90-day probationary period for health insurance coverage. This means that new employees in Arkansas usually need to wait for 90 days before their health insurance benefits take effect. This waiting period is in line with standard practices in the United States.

This information is not explicitly provided in the search results, but it is a common industry standard in the United States, as mentioned in the "90-Day Probationary Period for Insurance"

- The incontestability clause protects the insurance company. Under this clause, the company may contest a claim for the first 2 years, but not thereafter unless it can prove fraud. Companies are reluctant to charge fraud, however, since it requires proof of intent to deceive and is difficult to prove.

- The time limit on certain defenses clause is another name for the incontestability clause (generally up to 2 years, except for fraud).

- If a reinstatement application is required, an insured is reinstated when the company says or after 45 days, whichever comes first. When an insured is reinstated, a 10-day probationary period starts for sickness only.

- If no reinstatement application is required, an insured is reinstated effective upon payment of the late premium to either the company or the producer.

- Under the legal actions provision, if a claim is not paid immediately, the claimant must wait at least 60 days before filing a lawsuit for failure to pay. Such suits must be filed within 3 years of the original loss. Check your state regulations for the time limit in your state.

- Health insurers should pay individual claims as soon as possible, as specified in a provision known as timely payment of claims.

- The time payment of claims provision allows the claims department time to investigate (maximum of 60 days).

- Claims may be denied if they occur after policy expiration.

- Insurers do not have to pay unsubstantiated claims.

- After receipt of notice of claim, the insurer must send out claim

- Maternity benefits:

-

Glossary

Glossary of Insurance Terms in ArkansasGlossary

Accident – An unplanned, unforeseen event which occurs suddenly and at an unspecified place.

Accident Insurance – A type of insurance that protects the insured against loss due to accidental bodily injury.

Accidental Bodily Injury – Unplanned, unforeseen traumatic injury to the body.

Accidental Death and Dismemberment – An insurance policy which pays a specified amount or a specified multiple of the insured’s benefit if the insured dies, looses his/her sight, or loses two limbs due to an accident.

Accidental Death Benefits – A policy rider that states that the cause of death will be analyzed to determine if it complies with the policy description of accidental death. Activities of Daily Living (ADLs) – Activities individuals must do every day, such as moving about (transferring), getting dressed, eating, or bathing.

Actual Charge – The amount a physician or supplier actually bills for a particular service or supply Adhesion – A contract offered on a "take-it-or-leave-it" basis by an insurer, in which the insured's only option is to accept or reject the contract. Any ambiguities in the contract will be settled in favor of the insured.

Admitted (Authorized) Insurer – An insurance company authorized and licensed to transact insurance in a particular state.

Adult Day Care – A program for impaired adults that attempts to meet their health, social, and functional needs in a setting away from their homes.

Adverse Selection – The tendency of risks with higher probability of loss to purchase and maintain insurance more often than the risks who present lower probability.

Agent – An individual who is licensed to sell, negotiate, or effect insurance contracts on behalf of an insurer.

Aleatory – A contract in which participating parties exchange unequal amounts. Insurance contracts are aleatory in that the amount the insured will pay in premiums is unequal to the amount the insurer will pay in the event of a loss.

Alien Insurer – An insurance company that is incorporated outside the United States.

Alzheimer’s Disease – A disease that causes the victim to become dysfunctional due to degeneration of brain cells and severe memory loss.

Apparent Authority – The appearance or the assumption of authority based on the actions, words, or deeds of the principal or because of circumstances the principal created.

Approved Amount – The amount Medicare determines to be reasonable for a service that is covered under Part B of Medicare.

Assignment – A claim to a provider or medical supplier to receive payments directly from Medicare.

Attained Age – The age of the insured at a determined date.

Attending Physician’s Statement (APS) – A statement usually obtained from the applicant’s doctor.

Avoidance – A method of dealing with risk (e.g., if a person wanted to avoid the risk of being killed in an airplane crash, he/she might choose never to fly in a plane).

Basic Hospital Expense Insurance – Coverage that provides benefits for room, board and miscellaneous hospital expenses for a certain number of days during a hospital stay.

Basic Medical Expense Insurance – Coverage for doctor visits, x-rays, lab tests, and emergency room visits; benefits, however, are limited to specified dollar amounts.

Beneficiary – The person who receives the proceeds from the policy when the insured dies.

Benefit Period – The length of time over which the insurance benefits will be paid for each illness, disability or hospital stay.

Birthday Rule – The method of determining primary coverage for a dependent child, under which the plan of the parent whose birthday occurs first in the calendar year, is designated as primary.

Blanket Medical Insurance – A policy that provides benefits for all medical costs, including doctor visits, hospitalization, and drugs.

Boycott – An unfair trade practice in which one person refuses to do business with another until he or she agrees to certain conditions.

Buyer's Guide – A booklet that describes insurance policies and concepts, and provides general information to help an applicant make an informed decision.

Cafeteria Plan – A selection of health care benefits from which an employee may choose the ones that he/she needs.

Capital Amount – A percentage of the principal amount of a policy paid to the insured if he/she suffered the loss of an appendage.

Carriers – Organizations that process claims and pay benefits in an insurance policy.

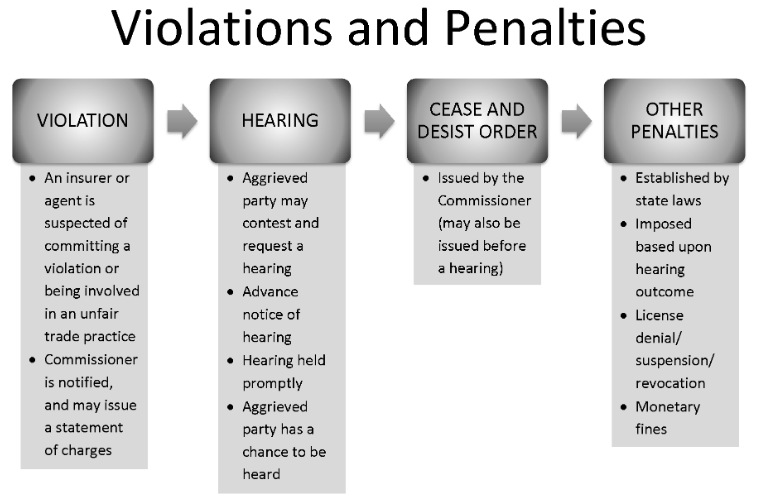

Cease and Desist Order – A demand of a person to stop committing an action that is in violation of a provision.

Certificate of Authority – A documents that authorizes a company to start conducting business and specifies the kind(s) of insurance a company can transact. It is illegal for an insurance company to transact insurance without this certificate.

Certificate of Insurance – A written document that indicates that an insurance policy has been issued, and that states both the amounts and types of insurance provided.

Claim – A request for payment of the benefits provided by an insurance contract.

COBRA (Consolidated Omnibus Budget Reconciliation Act of 1985) - The law that provides for the continuation of group health care benefits for the insured for up to 18 months if the insured terminates employment or is no longer eligible, and for the insured's dependents for up to 36 months in cases of loss of eligibility due to death of the insured, divorce, or attainment of the limiting age.

Coercion – An unfair trade practice in which an insurer uses physical or mental force to persuade an applicant to buy insurance.

Coinsurance – An agreement between an insurer and insured in which both parties are expected to pay a certain portion of the potential loss and other expenses.

Coinsurance Clause – A provision that states that the insurer and the insured will share the losses covered by the policy in a proportion agreed upon in advance.

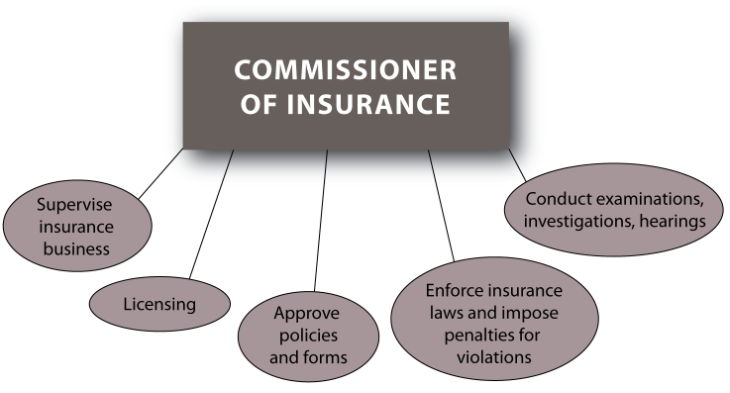

Commissioner – The chief executive and administrative officer of the Insurance Department.

Comprehensive Policy – A plan that provides a package of health care services, including preventive care, routine physicals, immunization, outpatient services and hospitalization.

Comprehensive Major Medical – A combination of basic coverage and major medical coverage that features low deductibles, high maximum benefits, and coinsurance.

Concealment – The withholding of known facts which, if material, can void a contract.

Conditional Contract – A type of an agreement in which both parties must perform certain duties and follow rules of conduct to make the contract enforceable.

Consideration – The binding force in a contract that requires something of value to be exchanged for the transfer of risk. The consideration on the part of the insured is the representations made in the application and the payment of premium; the consideration on the part of the insurer is the promise to pay in the event of loss.

Consideration Clause – A part of the insurance contract that states that both parties must give something of value for the transfer of risk, and specifies the conditions of the exchange.

Consumer Report – A written and /or oral statement regarding a consumer's credit, character, reputation, or habits collected by a reporting agency from employment records, credit reports, and other public sources.

Contract – An agreement between two or more parties enforceable by law.

Contributory – A group insurance plan that requires the employees to pay part of the premium.

Coordination of Benefits – A provision that helps determine the primary provider in situations where an insured is covered by more than one policy, thus avoiding claims overpayments.

Copayment – An arrangement in which an insured must pay a specified amount for services "up front" and the provider pays the remainder of the cost

Custodial Care – Care that is rendered to help an insured complete his/her activities of daily living.

Death Benefit – The amount payable upon the death of the person whose life is insured.

Deductible – The portion of the loss that is to be paid by the insured before any claim may be paid by the insurer.

Defamation – An unfair trade practice in which one agent or insurer makes an injurious statement about another with the intent of harming the person’s or company’s reputation.

Director – The chief executive and administrative officer of the Insurance Department.

Disability – A physical or mental impairment, either congenital or resulting from an injury or sickness. Disability Income Insurance – Health insurance that provides periodic payments to replace an insured’s income when he/she is injured or ill.

Disclosure – An act of identifying the name of the producer, representative or firm, limited insurance representative, or temporary insurance producer on any policy solicitation.

Domestic Insurer – An insurance company that is incorporated in the state.

Domicile of Insurer – Insurer's location of incorporation and the legal ability to write business in a state.

Dread (Specified) Disease Policy – A policy with a high maximum limit that covers certain diseases named in the contract (such as polio and meningitis).

Dual Choice – A federal requirement that employers who have 25 or more employees, who are within the service area of a qualified HMO, who pay minimum wage, and offer a health plan, must offer HMO coverage as well as an indemnity plan.

Eligibility Period – The period of time in which an employee may enroll in a group health care plan without having to provide evidence of insurability.

Elimination Period – A waiting period that is imposed on the insured from the onset of disability until benefit payments begin.

Emergency – An injury or disease which occurs suddenly and requires treatment within 24 hours.

Endodontics – An area of dentistry that deals with diagnosis, prevention and treatment of the dental pulp within natural teeth at the root canal.

Enrollment Period – The amount of time an employee has to sign up for a contributory group health plan.

Estoppel – A legal impediment to denying a fact or restoring a right that has been previously waived.

Excess Charge – The difference between the Medicare approved amount for a service or supply and the actual charge.

Expiration – The date specified in the policy as the date of termination.

Explanation of Benefits (EOB) – A statement that outlines what services were rendered, how much the insurer paid, and how much the insured was billed.

Explanation of Medicare Benefits – A statement sent to a Medicare patient indicating how the Medicare claim will be settled.

Exposure – A unit of measure used to determine rates charged for insurance coverage.

Express Authority – The authority granted to an agent by means of the agent's written contract.

Extended Care Facility – A facility which is licensed by the state to provide 24-hour nursing care.

Extension of Benefits – A provision that allows coverage to continue beyond the policy’s expiration date for employees who are not actively at work due to disability or who have dependents hospitalized on that date. This coverage continues only until the employee returns to work or the dependent leaves the hospital.

Fair Credit Reporting Act – A federal law that established procedures that consumer-reporting agencies must follow in order to ensure that records are confidential, accurate, relevant and properly used.

Fiduciary – An agent/broker who handles insurer's funds in a trust capacity.

Flexible Spending Account (FSA) – A salary reduction cafeteria plan that uses employee funds to provide various types of health care benefits.

Foreign Insurer – An insurance company that is incorporated in another state.

Fraternal Benefit Societies – Life or health insurance companies formed to provide insurance for members of an affiliated lodge, religious organization, or fraternal organization with a representative form of government.

Fraud – The intentional misrepresentation or deceit with the intent to induce a person to part with something of value.

Free Look – A period of time, usually required by law in other states than Arkansas, during which a policyowner may inspect a newly issued individual life or health insurance policy for a stated number of days and surrender it in exchange for a full refund of premium if not satisfied for any reason.

There is no legally mandated "free look" period for health insurance in Arkansas. However, some insurance companies offer a reasonable period, typically ranging from seven to 30 days, during which customers can cancel their policy without penalty. After this period, the policy may be cancelled if the premium is not paid within 30 days, leading to the cancellation of pending claims. Consumers should check their specific policy terms for details on cancellation provisions and grace periods.

Gatekeeper Model – A model of HMO and PPO organizations that uses the insured’s primary care physician (the gatekeeper) as the initial contact for the patient for medical care and for referrals.

Grace Period – Period of time after the premium due date in which premiums may still be paid, and the policy and its riders remain in force.

Group Disability Insurance – A type of insurance that covers a group of individuals against loss of pay due to accident or sickness.

Group Health Insurance – Health coverage provided to members of a group.

Hazard – A circumstance that increases the likelihood of a loss.

Hazard, Moral – The effect of a person’s reputation, character, living habits, etc. on his/her insurability.

Hazard, Morale – The effect a person’s indifference concerning loss has on the risk to be insured.

Hazard, Physical – A type of hazard that arises from the physical characteristics of an individual, such as a physical disability due to either current circumstance or a condition present at birth.

Health Insurance – Protection against loss due to sickness or bodily injury.

Health Maintenance Organization (HMO) – A prepaid medical service plan in which specified medical service providers contract with the HMO to provide services. The focus of the HMO is preventive medicine.

Health Reimbursement Accounts (HRAs) – Plans that allow employers to set aside funds for reimbursing employees for qualified medical expenses.

Health Savings Accounts (HSAs) – Plans designed to help individuals save for qualified health expenses.

Home Health Agency – An entity certified by the insured’s health plan that provides health care services under contract.

Home Health Care – Type of care in which part-time nursing or home health aide services, speech therapy, physical or occupational therapy services are given in the home of the insured.

Home Health Services – A covered expense under Part A of Medicare in which a licensed home health agency provides home health care to an insured.

Hospice – A facility for the terminally ill that provides supportive care such as pain relief and symptom management to the patient and his/her family. Hospice care is covered under Part A of Medicare.

Hospital Confinement Rider – An optional disability income rider that waives the elimination period when an insured is hospitalized as an inpatient.

The health insurance elimination period refers to the duration between the start of a disability and the commencement of benefit payouts from the insurer. It's essentially a waiting period during which the policyholder is responsible for covering all costs. Also termed as a "waiting period" or "qualifying period," it determines how long an individual must wait after becoming disabled before receiving benefits. Typically, longer elimination periods are associated with lower premium costs, while shorter periods mean higher premiums. Understanding this period is crucial for planning and managing healthcare expenses during a disability.

Implied Authority – Authority that is not expressed or written into the contract, but which the agent is assumed to have in order to transact the business of insurance for the principal.

Income Replacement Contracts – Policies which replace a certain percentage of the insured’s pure loss of income due to a covered accident or sickness.

Indemnify – To restore the insured to the same condition as prior to loss with no intent of loss or gain.

Insolvent organization – A member organization which is unable to pay its contractual obligations and is placed under a final order of liquidation or rehabilitation by a court of competent jurisdiction.

Insurability – The acceptability of an applicant who meets an insurance company’s underwriting requirements for insurance.

Insurance – A contract whereby one party (insurer) agrees to indemnify or guarantee another party (insured) against a loss by a specified future contingency or peril in return for payment of a premium.

Insured – The person or organization that is protected by insurance; the party to be indemnified.

Insurer – An entity that indemnifies against losses, provides benefits, or renders services (also known as "company" or "insurance company").

Insuring Clause – A general statement that identifies the basic agreement between the insurance company and the insured, usually located on the first page of the policy.

Intentional Injury – An act that is intended to cause injury. Self- inflicted injuries are not covered under accident insurance; intentional injuries inflicted on the insured by another are covered.

Intermediaries – Organizations that process inpatient and outpatient claims on individuals by hospitals, skilled nursing facilities, home health agencies, hospices and certain other providers of health services.

Intermediate Care – A level of care that is one step down from skilled nursing care; provided under the supervision of physicians or registered nurses.

Investigative Consumer Report – A report similar to a consumer report, but one that also provides information on the consumer’s character, reputation and habits.

Lapse – Termination of a policy because the premium has not been paid by the end of the grace period.

Law of Large Numbers – A principle stating that the larger the number of similar exposure units considered, the more closely the losses reported will equal the underlying probability of loss.

Limited Policies – Health insurance policies that cover only specific accidents or diseases.

Limiting Charge – The maximum amount a physician may charge a Medicare beneficiary for a covered service if the physician does not accept assignment of the Medicare approved amount.

Lloyd’s Associations – Organizations that provide support facilities for underwriters or groups of individuals that accept insurance risk.

Long-Term Care (LTC) – Health and social services provided under the supervision of physicians and medical health professionals for persons with chronic diseases or disabilities. Care is usually provided in a Long-Term Care Facility which is a state licensed facility that provides services.

Long-Term Disability Insurance – A type of individual or group insurance that provides coverage for illness until the insured reaches age 65 and for life in the case of an accident.

Loss – The reduction, decrease, or disappearance of value of the person or property insured in a policy, by a peril insured against.

Loss of Income Insurance – Insurance that pays benefits for inability to work because of disability resulting from accidental bodily injury or sickness.

Major Medical Insurance – A type of health insurance that usually carries a large deductible and pays covered expenses up to a high limit whether the insured is in or out of the hospital.

Medicaid – A medical benefits program jointly administered by the individual states and the federal government.

Medical Expense Insurance – A type of insurance that pays benefits for medical, surgical, and hospital costs.

Medical Information Bureau (MIB) – An information database that stores the health histories of individuals who have applied for insurance in the past. Most insurance companies subscribe to this database for underwriting purposes.

Medical Savings Account – An employer-funded account linked to a high deductible medical insurance plan.

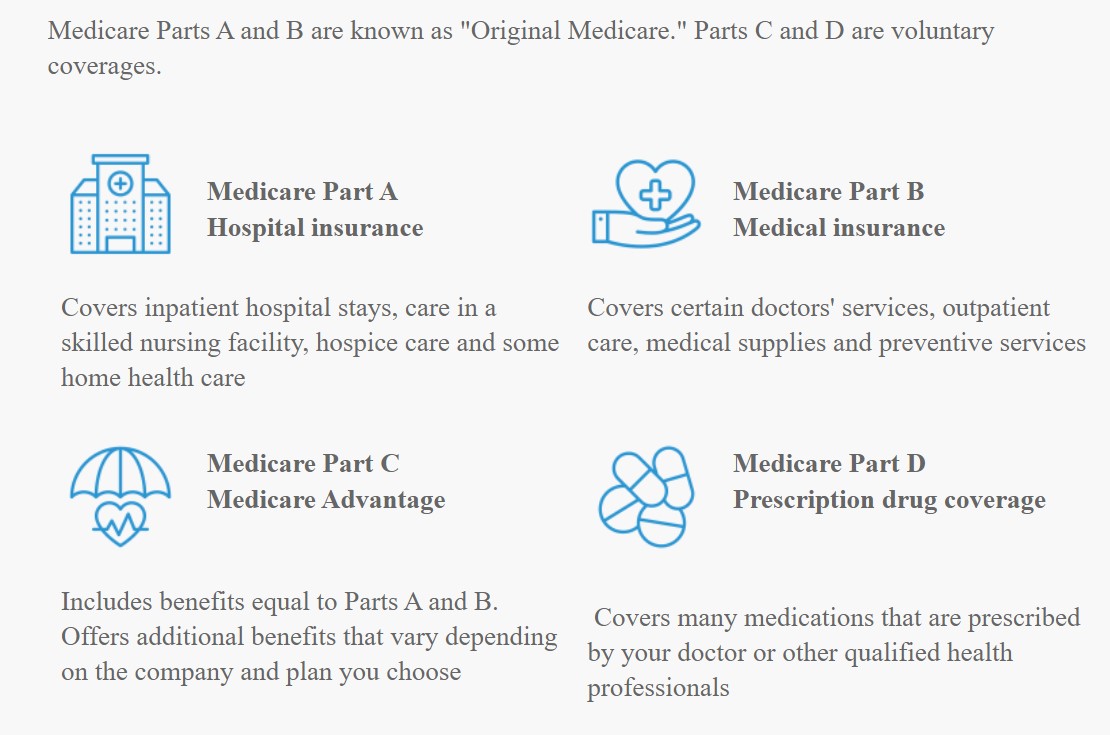

Medicare – The United States federal government plan for paying certain hospital and medical expenses for persons who qualify.

Medicare Supplement Insurance – A type of individual or group insurance that fills the gaps in the protection provided by Medicare, but that cannot duplicate any Medicare benefits.

Medigap – Medicare supplement plans issued by private insurance companies that are designed to fill some of the gaps in Medicare.

Misrepresentation – A false statement or lie that can render the contract void.

Morbidity Rate – The ratio of the incidence of sickness to the number of well persons in a given group of people over a given period of time.

Morbidity Table – A table showing the incidence of sickness at specified ages.

Multiple-Employer Trust (MET) – A group of small employers who do not qualify for group insurance individually, formed to establish a group health plan or self-funded plan.

An example of a Multiple-Employer Trust (MET) is a trust established by a group of more than ten unrelated employers in the same industry. They join the trust to provide benefits such as group medical coverage or 401(k) plans, aiming to reduce costs and administrative burdens.

Multiple Employer Welfare Association (MEWA) – Any entity of at least two employers, other than a duly admitted insurer, that establishes an employee benefit plan for the purpose of offering or providing accident and sickness or death benefits to the employees.

Mutual Companies – Insurance organizations that have no capital stock, but are owned by the policyholders.

Nonadmitted (Nonauthorized) – An insurance company that has not applied for, or has applied and been denied a Certificate of Authority and may not transact insurance in a particular state.

Noncancellable – An insurance contract that the insured has a right to continue in force by payment of premiums that remain the same for a substantial period of time.

Nonmedical – A life or health insurance policy that is underwritten based on the insured’s statement of health rather than a medical examination.

Nonrenewal – A termination of a policy by an insurer on the anniversary or renewal date.

Nonresident Agent – An agent licensed in a state in which the agent is not a resident.

Notice of Claim – A provision that spells out an insured’s duty to provide the insurer with reasonable notice in the event of a loss.

Oral Surgery – Operative treatment of the mouth such as extractions of teeth and related surgical treatment.

Orthodontics – A special field in dentistry which involves treatment of natural teeth to prevent and/or correct dental anomalies with braces or appliances.

Out-of-Pocket Costs – Amounts an insured must pay for coinsurance and deductibles before the insurer will pay its portion.

Over Insurance – An excessive amount of insurance that would result in overpayment to the insured in the event of a loss.

Partial Disability – Ability to perform some, but not all, of the duties of the insured's occupation as a result of injury or sickness.

Payment of Claims – A provision that specifies to whom claims payments are to be made.

Peril – The cause of a possible loss.

Periodontics – A specialty of dentistry that involves treatment of the surrounding and supporting tissue of the teeth such as treatment for gum disease.

Permanent Disability – Disability from which the insured does not recover. Persistency – The tendency or likelihood of insurance policies not lapsing or being replaced with insurance from another insurer.

Personal Contract – An agreement between an insurance company and an individual that states that insurance policies cover the individual's insurable interest.

Physical Exam and Autopsy – A provision that allows an insurer, at its own expense, to have an insured physically examined when a claim is pending or to have an autopsy performed where not prohibited by law.

Policyholder – The person who has possession of the policy, usually the insured.

Policyowner – The person who is entitled to exercise the rights and privileges in the policy. This person may or may not be the insured.

Preferred Provider Organization (PPO) – An organization of medical professionals and hospitals who provide services to an insurance company’s clients for a set fee.

Preferred Risk – An insurance classification for applicants who have a lower expectation of incurring loss, and who, therefore, are covered at a reduced rate.

Premium – A periodic payment to the insurance company to keep the policy in force.

Presumptive Disability – A provision that is found in most disability income policies which specifies the conditions that will automatically qualify the insured for full disability benefits.

Presumptive disability refers to medical conditions that are obviously or easily presumed to be a total disability. What is an examples of a presumptive disability? Presumptive disabilities include blindness, total hearing loss, and loss of speech or limbs.

Primary Policy – A basic, fundamental insurance policy which pays first with respect to other outstanding policies.

Principal Amount – The full face value of a policy.

Private Insurance – Insurance furnished by nongovernmental insuring organizations.

Pro Rata Cancellation – Termination of an insurance policy, with an adjustment of the premium charge in proportion to the exact coverage that has been in force.

Probationary Period – The period of time between the effective date of a health insurance policy and the date coverage for all or certain conditions begins.

A probationary period of 10 days begins for sickeness if there is a lapse of payments, after up to 45 days that the insurer receives payment, for example.

Producer – Insurance agent or broker.

Proof of Loss – A claim form that a claimant must submit after a loss occurs.

Prosthodontics – A special area of dentistry that involves the replacement of missing teeth with artificial devices like bridgework or dentures.

Provider – Any group or individual who provides health care services.

Pure Risk - The uncertainty or chance of a loss occurring in a situation that can only result in a loss or no change.

Rate Service Organization – An organization that is formed by, or on behalf of, a group of insurers to develop rates for those insurers, and to file the rates with the insurance department on behalf of its members. They may also act as a collection point for actuarial data.

Rebating – Any inducement offered in the sale of insurance products that is not specified in the policy.

Reciprocal Exchange – An unincorporated group of individuals who mutually insure one another, each separately assuming a share of each risk.

Reciprocity – A situation in which two parties provide the same help or advantages to each other (for example, Producer A living in State A can transact business as a nonresident in State B if State B's resident producers can transact business in State A).

Recurrent Disability – A policy provision that specifies the period of time during which the recurrence of an injury or illness will be considered a continuation of a prior period of disability.

Reduction – Lessening the possibility or severity of a loss.

Reinsurance – A form of insurance whereby one insurance company (the reinsurer) in consideration of a premium paid to it, agrees to indemnify another insurance company (the ceding company) for part or all of its liabilities from insurance policies it has issued.

Renewability Clause – A clause that defines the insurance company's and the insured’s right to cancel or renew coverage.

Representations – Statements made by the applicant on the insurance application that are believed to be true, but are not guaranteed to be true.

Rescission – The termination of an insurance contract due either to material misrepresentation by the insured or by fraud, misrepresentation, or duress on the part of the agent/insurer.

Reserve – An amount representing actual or potential liabilities kept by an insurer in a separate account to cover debts to policyholders.

Residual Disability – Type of disability income policy that provides benefits for loss of income when a person returns to work after a total disability, but is still not able to perform at the same level as before becoming disabled.

Respite Care – A type of temporary health or medical care provided either by paid workers who come to the home or by a nursing facility where a patient stays to give a caregiver a short rest.

Restorative Care – An area of dentistry that involves treatments that restore functional use to natural teeth such as fillings or crowns.

Rider – Any supplemental agreement attached to and made a part of the policy indicating the policy expansion by additional coverage, or a waiver of a coverage or condition.

Risk – Uncertainty as to the outcome of an event when two or more possibilities exist.

Risk, Pure – The uncertainty or chance of a loss occurring in a situation that can only result in a loss or no change.

Risk Retention Group – A liability insurance company owned by its members, which are exposed to similar liability risks by virtue of being in the same business or industry.

Risk, Speculative – The uncertainty or chance of a loss occurring in a situation that involves the opportunity for either loss or gain.

Risk, Standard – An applicant or insured who is considered to have an average probability of a loss based on health, vocation and lifestyle.

Risk, Substandard – An applicant or insured who has a higher than normal probability of loss, and who may be subject to an increased premium.

Service Plans – Insurance plans where the health care services rendered are the benefits instead of monetary benefits.

Short-Rate Cancellation – Canceling the policy with a less than proportionate return of premium.

Short-Term Disability Insurance – A group or individual policy that covers disabilities of 13 to 26 weeks, and in some cases for a period of up to two years.

Sickness – A physical illness, disease, or pregnancy, but not a mental illness.

Skilled Nursing Care – Daily nursing care or skilled care, such as administration of medication, diagnosis, or minor surgery that is performed by or under the supervision of a skilled professional.

Standard Provisions – Requirements approved by state law that must appear in all insurance policies.

Standard Risk – An applicant or insured who is considered to have an average probability of a loss based on health, vocation and lifestyle.

Stock Companies – Companies owned by the stockholders whose investments provide the capital necessary to establish and operate the insurance company.

Subrogation – The legal process by which an insurance company seeks recovery of the amount paid to the insured from a third party who may have caused the loss.

Substandard Risk – An applicant or insured who has a higher than normal probability of loss, and who may be subject to an increased premium.

Superintendent (Commissioner, Director) – The head of the state department of insurance.

Terminally Ill – In most states, this is defined as a patient who is expected to die within 6 months of a specific illness or sickness.

Total Disability – A condition which does not allow a person to perform the duties of any occupation for payment as a result of injury or sickness.

Twisting – A form of misrepresentation in which an agent persuades an insured/owner to cancel, lapse, or switch policies, even when it's to the insured's disadvantage.

Underwriter – A person who evaluates and classifies risks to accept or reject them on behalf of the insurer. Underwriting – The process of reviewing, accepting or rejecting applications for insurance.

Unearned Premium – The portion of premium for which policy protection has not yet been given.

Unilateral Contract – A contract that legally binds only one party to contractual obligations after the premium is paid.

Utmost Good Faith – The fair and equal bargaining by both parties in forming the contract, where the applicant must make full disclosure of risk to the company, and the insurance company must be fair in underwriting the risk.

Waiting Period – Time between the beginning of a disability and the start of disability insurance benefits.

Waiver – The voluntary abandonment of a known or legal right or advantage.

Warranty – A material stipulation in the policy that if breached may void coverage.

Workers Compensation – Benefits required by state law to be paid to an employee by an employer in the case of injury, disability, or death as the result of an on-the-job hazard

-

General Insurance

General Insurance ArkansasGeneral Insurance

Before you learn the different types of policies that you will encounter as an insurance producer, you will need to understand some basic terminology and concepts. First, you need to understand what insurance is and who or what may become insured. This chapter will discuss some basic underwriting concepts, address different classifications of insurers, and will end with an explanation of contracts. In general, this chapter will help build a foundation of concepts that will make it easier for you to learn the rest of the material in this course, so it is important for you to master these ideas before moving on to the next chapter.

TERMS TO KNOW

- Agent/Producer: A legal representative of an insurance company; the classification of producer usually includes agents and brokers; agents are the agents of the insurer.

- Applicant or proposed insured: A person applying for insurance.

- Beneficiary: A person who receives the benefits of an insurance policy.

- Broker: An insurance producer not appointed by an insurer and is deemed to represent the client.

- Indemnity: Main principle of insurance, meaning that the insured cannot recover more than their loss; the purpose of insurance is to restore the insured to the same position as before the loss.

- Insurance policy: A contract between a policyowner (and/or insured) and an insurance company which agrees to pay the insured or the beneficiary for loss caused by specific events.

- Insured: The person covered by the insurance policy. This person may or may not be the policyowner.

- Insurer (principal): The company who issues an insurance policy.

- Law of large numbers: The larger the number of people with a similar exposure to loss, the more predictable actual losses will be.

- Policyowner: The person entitled to exercise the rights and privileges in the policy.

- Premium: The money paid to the insurance company for the insurance policy.

- Reciprocity/Reciprocal: A mutual interchange of rights and privileges.

A. Concepts

Insurance is a contract in which one party (the insurance company) agrees to indemnify (make whole) the insured party against loss, damage, or liability arising from an unknown event. In life insurance, the policy protects survivors from losses suffered after an insured's death.

Insurance is a transfer of risk of loss from an individual or a business entity to an insurance company, which, in turn, spreads the costs of unexpected losses to many individuals. If there were no insurance mechanism, the cost of a loss would have to be borne solely by the individual who suffered the loss.

Know This! Insurance is the transfer of risk of loss. The cost of an insured's loss is transferred over to the insurer and spread among other insureds.

Risk Risk is the uncertainty or chance of a loss occurring. The two types of risks are pure and speculative, only one of which is insurable.

- Pure risk refers to situations that can only result in a loss or no change. There is no opportunity for financial gain. Pure risk is the only type of risk that insurance companies are willing to accept.

- Speculative risk involves the opportunity for either loss or gain. An example of speculative risk is gambling. These types of risks are not insurable.

Know This! Only pure risks are insurable.

Hazard Hazards are conditions or situations that increase the probability of an insured loss occurring. Hazards are classified as physical hazards, moral hazards, or morale hazards. Conditions such as lifestyle and existing health, or activities such as scuba diving, are hazards and may increase the chance of a loss occurring.

- Physical hazards are individual characteristics that increase the chances of the cause of loss. Physical hazards exist because of a physical condition, past medical history, or a condition at birth, such as blindness.

- Moral hazards are tendencies towards increased risk. Moral hazards involve evaluating the character and reputation of the proposed insured. Moral hazards refer to those applicants who may lie on an application for insurance or in the past have submitted fraudulent claims against an insurer.

- Morale hazards are similar to moral hazards, except that they arise from a state of mind that causes indifference to loss, such as carelessness. Actions taken without forethought may cause physical injuries.

Peril Perils are the causes of loss insured against in an insurance policy.

- Life insurance insures against the financial loss caused by the premature death of the insured.

- Health insurance insures against the medical expenses and/or loss of income caused by the insured's sickness or accidental injury.

- Property insurance insures against the loss of physical property or the loss of its income-producing abilities.

- Casualty insurance insures against the loss and/or damage of property and resulting liabilities.

Loss Loss is defined as the reduction, decrease, or disappearance of value of the person or property insured in a policy, caused by a named peril. Insurance provides a means to transfer loss.

Know This! A risk is a chance that a loss will occur; a hazard increases the probability of loss; a peril is the cause of loss.

Exposure Exposure is used to determine the cost of an insurance premium for coverage. It is a unit of measure.

Know This! Exposure is a unit of measure used to determine the premium for coverage.

Avoidance Avoiding a risk means that one changes their plans in order to avoid a loss. An example is not flying in order to avoid the risk of a plane crash.

Retention Retention means to save, in this context. The individual saves the money needed to cover the potential loss. The purpose of retention is to reduce the cost of insuring the potential loss.

Sharing Sharing a risk is accomplished when several individuals agree to pay a specific amount of money if a loss occurs. This is accomplished in the form of a sharing agreement. An example of risk sharing is a fraternal organization or a social club.

Reduction Reduction means to lessen the possibility of loss. To minimize the chance of loss, the insured can participate in risk reduction. Examples of risk reduction include installing a security system in a home or taking a safe driving course.

Transfer Transfer refers to the risk being transferred to the insurer. Insurance is a means of transferring the financial risk of a loss, as you learned in the previous chapters.

Insurance and Gambling Insurance and gambling share many of the same characteristics, but there are key differences between them. Both insurance and gambling involve risk and speculation. However, gambling is not insurable, while insurance is. There are several key differences between the two:

-

Insurance is a form of risk management. It's designed to protect individuals and organizations from financial loss by transferring the risk to an insurance company. In contrast, gambling is typically a recreational activity that involves wagering money or valuables on an uncertain outcome. It's not a risk management tool but rather a form of entertainment.

-

Insurance involves insurable interest. To purchase insurance, the policyholder must have a legitimate financial interest in the insured property or person. This ensures that insurance is used to protect against potential losses, not to create opportunities for financial gain. In gambling, there's no requirement for insurable interest; people can place bets on various outcomes regardless of their connection to the event.

-

Insurance is based on the principle of indemnity, which means that the policyholder should be compensated for the actual financial loss incurred due to an insured event. In gambling, there's no guarantee of compensation or a one-to-one relationship between the amount wagered and the potential payout.

-

Insurance is regulated by government authorities and subject to legal and contractual obligations. Gambling may also be regulated, but it's primarily subject to rules established by the gambling provider, such as casinos or online betting platforms.

In summary, insurance and gambling both involve risk, but insurance is a risk management tool that provides financial protection against losses, while gambling is a form of entertainment that often lacks the legal and contractual structure associated with insurance policies.

Insurance as a Contract An insurance policy is a legally binding contract between the policyholder and the insurance company. Contracts are agreements between two parties that create legal obligations. In the case of insurance, the contract outlines the rights and responsibilities of both the policyholder and the insurer.

Key elements of an insurance contract include:

-

Offer and acceptance: The contract is formed when the policyholder (offeror) makes an offer by submitting an application and paying the initial premium. The insurance company (offeree) accepts the offer by issuing a policy.

-

Consideration: Consideration refers to something of value exchanged between the parties. In an insurance contract, the policyholder pays premiums in exchange for the insurer's promise to provide coverage.

-

Legal purpose: The contract must be for a legal and insurable purpose. For example, an insurance contract that covers illegal activities would be void.

-

Competent parties: Both the policyholder and the insurer must be legally competent, meaning they have the legal capacity to enter into a contract. For example, minors generally lack the capacity to enter into contracts, so they may not be able to purchase insurance.

-

Offer and acceptance: The contract is formed when the policyholder (offeror) makes an offer by submitting an application and paying the initial premium. The insurance company (offeree) accepts the offer by issuing a policy.

-

Consideration: Consideration refers to something of value exchanged between the parties. In an insurance contract, the policyholder pays premiums in exchange for the insurer's promise to provide coverage.

-

Legal purpose: The contract must be for a legal and insurable purpose. For example, an insurance contract that covers illegal activities would be void.

-

Competent parties: Both the policyholder and the insurer must be legally competent, meaning they have the legal capacity to enter into a contract. For example, minors generally lack the capacity to enter into contracts, so they may not be able to purchase insurance.

-

Offer and acceptance: The contract is formed when the policyholder (offeror) makes an offer by submitting an application and paying the initial premium. The insurance company (offeree) accepts the offer by issuing a policy.

-

Consideration: Consideration refers to something of value exchanged between the parties. In an insurance contract, the policyholder pays premiums in exchange for the insurer's promise to provide coverage.

-

Legal purpose: The contract must be for a legal and insurable purpose. For example, an insurance contract that covers illegal activities would be void.

-

Competent parties: Both the policyholder and the insurer must be legally competent, meaning they have the legal capacity to enter into a contract. For example, minors generally lack the capacity to enter into contracts, so they may not be able to purchase insurance.

-

Legal purpose: The contract must be for a legal and insurable purpose. For example, an insurance contract that covers illegal activities would be void.

-

Competent parties: Both the policyholder and the insurer must be legally competent, meaning they have the legal capacity to enter into a contract. For example, minors generally lack the capacity to enter into contracts, so they may not be able to purchase insurance.

Principles of Insurance Several fundamental principles govern insurance contracts and operations, including:

-

Utmost good faith: Both parties to the insurance contract must act in good faith and honesty. The insured must provide accurate and complete information when applying for coverage, and the insurer must provide clear policy terms and process claims promptly and fairly.

-

Insurable interest: The policyholder must have an insurable interest in the subject of the insurance. This means that the policyholder must have a legitimate financial interest in the insured person or property. Insurable interest ensures that insurance is used for protection rather than speculation.

-

Indemnity: The principle of indemnity states that insurance is designed to compensate the policyholder for the actual financial loss incurred due to a covered event. It should not result in financial gain.

-

Subrogation: Subrogation is the right of the insurer to take legal action against third parties responsible for a loss that the insurer has paid. It prevents the insured from collecting twice for the same loss.

-

Contribution: When multiple insurance policies cover the same loss, the principle of contribution ensures that each insurer pays a proportionate share based on policy limits. This prevents the policyholder from profiting from a loss.

-

Proximate cause: Proximate cause is the primary cause of a loss or damage. Insurance policies cover losses caused by perils specified in the policy, and the proximate cause determines whether a loss is covered.

-

Unilateral contract: An insurance contract is a unilateral contract because only the insurer makes a legally binding promise to pay in exchange for the policyholder's premium. The policyholder can choose to accept or reject the offer but must pay the premium to have coverage.

-

Conditional contract: Insurance contracts contain conditions that must be met for the policy to be valid. For example, the insured must pay premiums on time and adhere to other policy conditions.

-

Personal contracts: Insurance contracts are typically personal contracts between the insured and the insurer. They cannot be transferred to another party without the insurer's consent.

-

Aleatory contracts: Aleatory contracts involve an element of chance, as the amount paid by the insurer (benefit) may be significantly greater than the premiums paid by the policyholder.

These principles are essential for understanding how insurance contracts work and the obligations of both the insurer and the insured. Adhering to these principles ensures a fair and equitable insurance system.

-

Accident & Health Insurance Basics

Accident & Health Insurance Basics for Arkansas Insurance LawsAccident And Health Insurance Basics

This section will present different classes of health insurance policies, as well as concepts that generally apply to health insurance. You will begin by learning about the principal types of losses and benefits, common exclusions from coverage, and producer’s responsibilities and liabilities for errors. This section will take an in-depth look at health insurance underwriting. This type of underwriting is particularly prone to unfair discrimination because of the presence of certain health conditions and the use of genetic information. Finally, you will learn about the concept of policy replacement and factors to consider in determining the best course of action.

TERMS TO KNOW

- Comprehensive coverage — health insurance that provides coverage for most types of medical expenses

- Copayment — an arrangement in which an insured must pay a specified amount for services "up front" and the provider pays the remainder of the cost

- Deductible — the portion of the loss that is to be paid by the insured before any claim may be paid by the insurer

- Dependent — someone relying on the insured for support

- Enrollee — a person enrolled in a health insurance plan, an insured (doesn't include dependents of the insured)

- Insolvent — unable to meet financial obligations

- Pre-existing conditions — conditions for which the insured has received diagnosis, advice, care, or treatment during a specific time period prior to the application for health coverage

- Riders — added to the basic insurance policy to add, modify or delete policy provisions

- Solicitation — an attempt to persuade a person to buy an insurance policy; it can be done orally or in writing

- Waiting period — a period of time that must pass after a loss occurs before the insurer starts paying policy benefits

A. Definition Of Perils

There are two major causes of loss (perils) under a health insurance policy. Policies may cover both accident and sickness or accident only.

-

Accidental Injury - Accidental bodily injury is an unforeseen and unintended injury that resulted from an accident rather than a sickness.

-

Sickness - Sickness is normally defined as an illness that first manifests itself while the policy is in force. The majority of health insurance claims result from sickness rather than accidental injury. An emergency medical condition is one which is so severe in pain or symptoms that if not treated quickly and properly could cause serious bodily harm, or possibly death.

Know This! The two major perils covered in health insurance policies are accidental bodily injury and sickness.

B. Types Of Losses And Benefits

-

Loss of Income from Disability - Loss of income caused by accident and/or sickness that results in the insured's inability to work and earn income is covered under disability income policies or coverages. Disability income insurance is a valued contract or stated amount that pays weekly or monthly benefits due to an injury or sickness. Benefits may be determined by the insured's past earnings and may be limited to a percentage of that income.

-

Medical Expense - A medical expense contract covers many of the expenses one incurs from an accident or sickness, such as a physician or hospital expense. Expenses may be paid directly to the insured, and the insured would be responsible for paying the medical expenses. This type of benefit payment is called reimbursement. If expenses are paid on a scheduled basis, the insurance company will refer to a list determining the cost of the treatment, and it will only pay up to a certain amount. If a person were covered as a dependent under their spouse’s group insurance, payment of medical expenses would be coordinated.

Know This! Medical expense benefits are considered reimbursement benefits.

- Long-term Care Expense - Long-term care policies provide benefits for medically necessary services that an insured receives in a nursing home or their own home (home health care), but not care received in an acute care unit of a hospital.

C. Common Exclusions From Coverage

The following losses are typically not covered in individual or group medical expense policies:

- War or act of war injuries or sicknesses; active military duty may also be excluded from coverage;

- Intentionally self-inflicted injuries;

- Elective cosmetic surgery; however, if treatment is required to correct a condition due to an accident or a birth defect, or is medically necessary, then coverage may be available;

- Experimental/investigation procedures;

- Conditions covered by workers compensation if they are covered under workers compensation laws or other legislation;

- Government plans: health insurance policies exclude expenses either paid or eligible for payment under Medicare or other federal, state, or local medical expense program;

- Participation in criminal activity: if a person is injured while committing an illegal act, health insurance will not cover the expense of the injury;

- Injuries resulting from drug or alcohol intoxication (unless administered by a physician).

D. Process Of Issuing A Health Insurance Policy

- Field Underwriting - Underwriting is the first step in the total process of insuring health risks. The basic purpose of health insurance underwriting is to minimize the problem of adverse selection. Adverse selection involves the fact that those most likely to have claims are those who are most likely to seek insurance. An insurance company that has sound underwriting guidelines will avoid adverse selection more often than not. In health insurance, field underwriting is far more important than in life insurance. The basic purpose of health insurance underwriting is to minimize the problem of adverse selection. Adverse selection involves the fact that those most likely to have claims are those who are most likely to seek insurance. An insurance company that has sound underwriting guidelines will avoid adverse selection more often than not. Note that the specific underwriting requirements will vary by insurer. Moral hazard is a significant factor in health insurance underwriting because of the possibility of malingering, and it is the agent, not the home office underwriter, who actually has personal contact with the applicant. It is the responsibility of the agent to ask the applicant questions clearly and precisely and to record the answers accurately. A producer's function as the field underwriter is to gather credible information from an applicant that would assist the underwriter in screening marginal or unacceptable risks before taking an application for an insurance policy.

Know This! A producer is the company's field underwriter.

Application Procedures - An application for insurance begins with a form provided by the company and completed by the agent as questions are asked of the applicant, and the applicant’s responses are recorded. This form – often called the “app” – is then submitted to the insurance company for its approval or rejection. The application is the applicant’s written request to the insurance company to issue a policy or contract based upon the information contained in the application. If the policy is issued, a copy of this application is stapled in the back of the policy, and it becomes part of the entire contract. A notice to the applicant must be issued to all applicants for health insurance coverage. This notice informs the applicant that a credit report will be ordered concerning their past history and any other health insurance for which the applicant has previously applied. The agent must leave this notice with the applicant.

Completeness and Accuracy - The agent must take special care with the accuracy of the application in the interest of both the company and the insured. Because the application is often the main source of underwriting information, it is the agent's responsibility to make certain that the application is filled out completely, correctly, and to the best of the applicant's knowledge.

Know This! It is the agent's responsibility to make sure that an application for insurance is complete and accurate to the best knowledge of the applicant.

Signatures - Every health insurance application requires the signature of the proposed insured, the policyowner (if different than the insured), and the agent who solicits the insurance.

Changes in the Application - Because the application is so important, most companies require that it be filled out in ink. The agent might make a mistake when filling out the app or the applicant might answer a question incorrectly and want to change it. There are two ways to correct an application. The first and best is to simply start over with a fresh application. If that is not practical, draw a line through the incorrect answer and insert the correct one. The applicant must initial the correct answer.

Know This! Any changes on the application must be initialed by the applicant or insured.

Premiums with the Application - Under the terms of the insurability conditional receipt, the insurance coverage becomes effective as of the date of the receipt, provided the application is approved. This receipt is generally provided to the applicant when the initial premium is paid at the time of application.

Disclosure of Information about Individuals - An insurance company or an agent cannot disclose any personal or privileged information about an individual unless any of the following occurs:

- A written authorization by the individual dated and signed within the past 12 months has been provided;

- The information is being provided to all of the following:

- An insurance regulatory authority or law enforcement agency, pursuant to the law;

- An affiliate for an audit, but no further disclosure is to be made;

- A group policyholder for the purpose of reporting claims experience;

- To an insurance company or self-insured plan for coordination of benefits;

- A lien holder, mortgagee, assignee, or other persons having a legal or beneficial interest in a policy of insurance.

- Company Underwriting - The underwriter’s function is to select risks that are acceptable to the insurance company. The selection criteria used in this process, by law, must be only those items that are based on sound actuarial principles or expected experience. The underwriter cannot decline a risk based on blindness or deafness, genetic characteristics, marital status, or sexual orientation. When underwriting health insurance policies, the prime considerations are age, gender, occupation, physical condition, avocations, moral and morale hazards, and financial status of the applicant.

Sources of Underwriting Information

- Application - An accurate and thorough application is imperative to the insurance company.

- Producer Report - Only the agent/producer is involved in completing the agent’s (producer's) report. It asks questions about the length of time that the applicant has been known to the agent, an estimate of the applicant’s income and net worth, and whether the agent knows of any reason that the contract should not be issued. The agent’s statement does not become part of the entire contract.

- Attending Physician Statement - If the underwriter deems it necessary, an attending physician’s statement (APS) will be sent to the applicant’s doctor to be completed. This source of information is best for accurate information on the applicant’s medical history. The physician can explain exactly what the applicant was treated for, the treatment required, the length of treatment and recovery, and the prognosis.

- Investigative Consumer (Inspection) Report - An investigative consumer report includes information on an applicant’s character, general reputation, personal habits, and mode of living that is obtained through investigation. For example, this report could include interviews with associates, friends, and neighbors of the applicant. Such reports may not be performed unless the applicant is clearly and accurately informed of the report in writing. The consumer report notification is usually part of the application. At the time that the application is completed, the agent will separate the notification and give it to the applicant.

- Medical Information Bureau (MIB) - The Medical Information Bureau (MIB) is a membership corporation owned by member insurance companies. It is a nonprofit trade organization that receives adverse medical information from insurance companies and maintains confidential medical impairment information on individuals. Reports on previous insurance information can be obtained from the Medical Information Bureau. Members of MIB can request a report on an applicant and receive coded information from any other applications for insurance submitted to other MIB members. MIB information cannot be used in and of itself to decline a risk, but it can give the underwriter important additional information.

Classification of Risks - Once the underwriters have collected and reviewed all the necessary information on the applicant, they will make a decision to either accept or decline the applicant for insurance. The applicants that have been accepted will fall into one of the 3 categories: preferred, standard, or substandard.